The five pillars of corporate risk management

Deloitte's survey indicates that companies are monitoring a greater number of risks; the result highlights an increase in concern – and consequently actions taken – from organizations, given the transformations and ambiguities of the business environment.

October – December | 2017Held within a complex and challenging economic and business context in Brazil, the 2017 Edition of the Deloitte’s annual survey on risk management intelligence, “The Five Corporate Risk Pillars – How to manage them in a challenging business and economic scenario”, presented the trends and the paths to a new cycle of maturity for the role in the country.

The survey, carried out with 100 companies that operate in Brazil, indicates that the interviewed organizations are monitoring a greater number of risks compared to its previous edition, held in 2015. The data show an increase in concern – and consequently actions taken – from organizations that operate in Brazil in managing risks more effectively, given the transformations and ambiguities of the Country’s business environment.

The priorities that emerge from the risk management process indicated by the companies suggest the focus of this role on cash flow and on results. However, the attention to the establishment of ethical practices and a culture of governance and compliance remains relevant, while macroeconomic topics – such as credit and interest rate – gain importance, wrapped up in the economic moment.

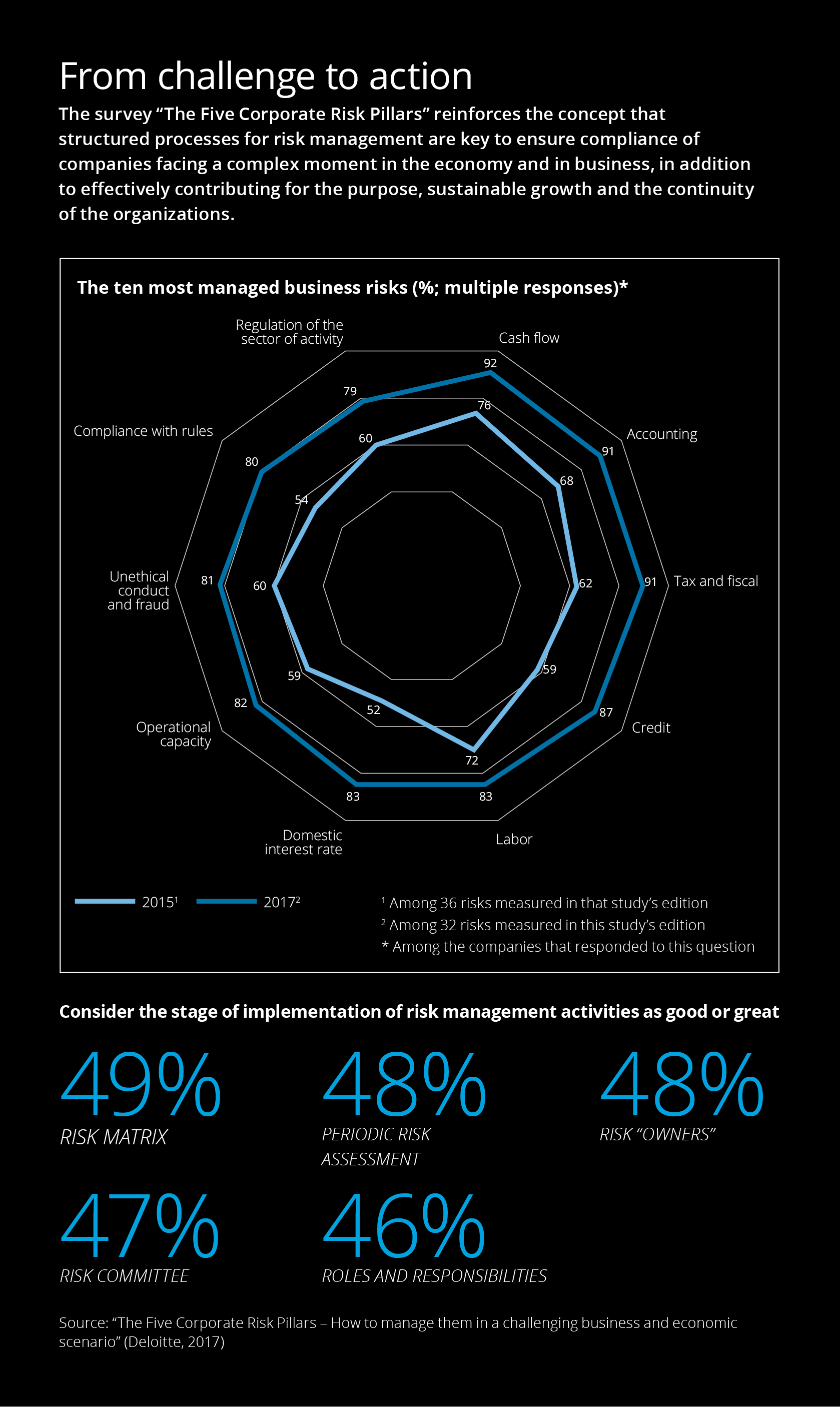

From challenge to action

The survey “The Five Corporate Risk Pillars” reinforces the concept that structured processes for risk management are key to ensure compliance of companies facing a complex moment in the economy and in business, in addition to effectively contributing for the purpose, sustainable growth and the continuity of the organizations.

The ten most managed business risks (%; multiple responses) *

| 20151 | 20172 | |

| Regulation of the sector of activity | 60 | 79 |

| Cash flow | 76 | 92 |

| Accounting | 68 | 91 |

| Tax and fiscal | 62 | 91 |

| Credit | 59 | 87 |

| Labor | 72 | 83 |

| Domestic interest rate | 52 | 83 |

| Operational capacity | 59 | 82 |

| Unethical conduct and fraud | 60 | 81 |

| Compliance with rules | 54 | 80 |

| Among 36 risks measured in that study’s edition

Among 32 risks measured in this study’s edition * Among the companies that responded to this question |

||

Consider the stage of implementation of risk management activities as good or great

Risk matrix 49%

Periodic risk assessment 48%

Risk “Owners” 48%

Risk committee 47%

Roles and responsibilities 46%

Source: “The Five Corporate Risk Pillars – How to manage them in a challenging business and economic scenario” (Deloitte, 2017)