Stock exchange adventure

Recessed economy and political instability are not obstacles for companies to include IPO in their funding strategies, especially given the scarcity of public funding; the appropriate preparation, however, is a key point

July-September | 2017In February 2017, the car rental company Movida held its Initial Public Offering (IPO) at B3, new name of BM&FBovespa, raising R$ 645.1 million with the sale of its shares, the first IPO of the year. A few days later, it was the turn of the diagnostic company Hermes Pardini, from Minas Gerais, to hold its offering, which raised R$ 877 million. In April, Azul Linhas Aéreas also became public, raising R$ 2.02 billion with its initial offering.

With the three IPOs, the first half of the year was busy for the Brazilian capital market, putting an end to a lengthy period: between 2014 and 2016, only three companies went public to raise funds. The movement included also the Netshoes group, a sporting goods and fashion e-commerce, which, also in April, held its IPO, but on the New York Stock Exchange (NYSE). And, in July, it was the time of Carrefour’s IPO on B3, raising more than R$ 5.1 billion – the biggest IPO in Brazil since 2013.

Deloitte, B3 and IBRI talk about opportunities in the capital market

At a time when the Brazilian economy is showing light signs of resumption, companies that are becoming public bet on medium and long-term benefits of being on the stock exchange. Among them, access to new investors, the possibility of financing for their expansion strategies at a time when public money is more scarce and gains of reputation and image.

“The decision to hold the IPO, instead of assuming a conventional debt to finance the company’s expansion, came from the intention to divide our business plan with investors with a long-term vision” says Renato Franklin, CEO of Movida.

Created in 2006, the car rental company was acquired in 2013 by the JSL Group, one of the largest Latin American logistics operators, which started an ambitious expansion plan, aimed at gaining scale and gaining new customers. At the time of the acquisition, Movida had an annual revenue of R$ 90 million, with a fleet of 2,300 vehicles and 26 stores. Attentive to changes in the urban mobility pattern that came with a bigger travel services and applications offer, Movida built a strategy focused on gaining space with Individual customers with the support of technology platforms and opened stores near intercity travel bus stations and lower purchasing power neighborhoods – without, however, losing sight of the corporate fleet management. The result was: the company more than doubled in size in the last three years, closing 2016 with a revenue of R$ 1.9 billion, a fleet of 60,000 vehicles and 250 stores across the country.

According to Franklin, the entry on the stock exchange, especially in the New Market, the segment with the strictest governance standards, was a step that came naturally, so that the company can keep the profitable growth path. “Movida already had publicly-held company concepts such as innovation and the fact that are in a changing urban mobility market. IPO was a natural path” said the CEO of the company.

With the entry on the stock exchange, Movida seeks a new expansion cycle, with the goal of doubling the company’s size in the next five years. According to Franklin, the car rental market has room to grow in Brazil, since the fleet aimed at this end does not even represent 1% of cars circulating on the streets across the country – there are 350,000 cars within a universe of 50 million vehicles. Moreover, only 12% of corporate fleets are outsourced, while in countries such as the United Kingdom, this index reaches 70%.

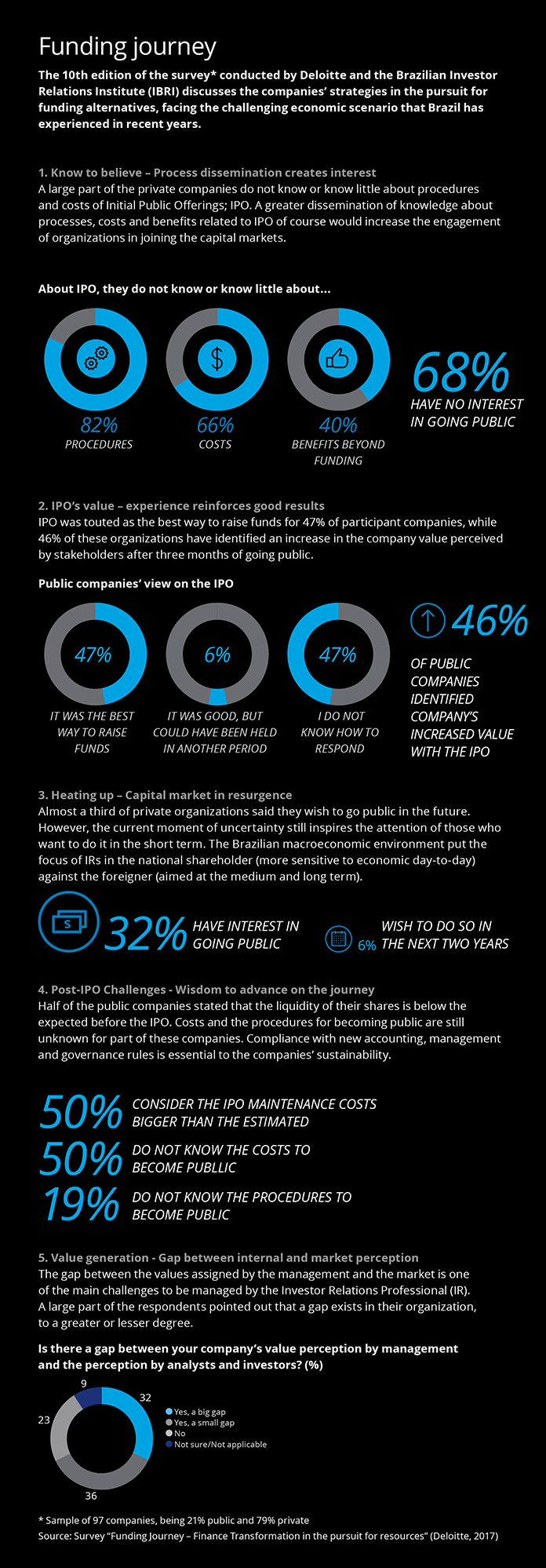

Financing expansion strategies is one of the main reasons that lead companies to become public. In a moment of a more recessed economy, the stock exchange has been one of the most reliable options to raise funds, even with the market and shares liquidity fluctuations. That’s what the “Funding Journey – Finance transformation in the search for resources” survey, conducted by Deloitte, in partnership with the Brazilian Investor Relations Institute (IBRI), has shown (see more details about the study in the box). In its tenth edition, the survey was conducted between April and May 2017 and included the participation of 97 companies, 20 of them being publicly held and 77 privately held. For 47% of publicly held companies that participated in the survey, the IPO was the best way to raise funds that was available at the time they decided for it.

Our survey shows the maturity of the Brazilian market, which recognizes a value gain for publicly held companies. Such value is obtained from the adjustments to compliance, transparency and governance rules necessary to companies from the moment they decide to go public., Fernando Augusto, Deloitte's Capital Markets partner.

“The survey has shown that there are private companies with high revenue and growth plans that, at some point, will need resources to expand or maintain the business. As the financing capacity by means of public banks is reduced, the solution is go to the market” says Fernando Augusto, a Deloitte’s Capital Markets partner.

The ups and downs of the stock exchange and underwhelming liquidity are, in fact, factors of concern for companies – for 54% of publicly held companies inquired by the survey, the liquidity of their shares is below than expected before the IPO. At the same time, 46% of publicly held companies identified increased company value after the IPO. For Augusto, this value gain reflects the adjustments to compliance, transparency and governance rules necessary to companies listed on the stock exchange. In short, a company listed on the stock exchange is seen as solid and with greater credibility.

High tech debut

Increase the company’s capitalization, gain financial flexibility, create a public market for the common shares and facilitate future access to the capital market – these were the reasons for Netshoes to become public, in April this year. The IPO on the New York Stock Exchange (NYSE) earned the company US$ 138.9 million, with the shares being traded at a unit price of $18, reaching the retailer’s initial expectation, which was to raise at least $100 million.

The choice for the debut on the American stock exchange was very well-planned and strategic for the company, currently one of the country’s largest e-commerce sites, with operations in other Latin American countries, such as Argentina and Mexico. “The option for the NYSE occurred mainly as a matter of Netshoes’ strategic positioning in the technology market, which is our core business, next to large worldwide companies in the sector”, says Otavio Lyra, Netshoes’ Investor Relations (IR) Officer. According to the officer, the company acted on improvements in the Latin American macroeconomic scenario and on the investors’ appetite for new stock offerings.

During the IPO, Netshoes put into circulation approximately 25% of the company’s shares, and, as the lock-up (period in which shareholders and administrators cannot sell the shares) of investors previous to the IPO ends, Lyra believes that the tendency will be for larger trading volumes. The IPO resources should help Netshoes in its goal of becoming one of Brazil’s largest e-commerce sites.

Today, the company is the largest in the sporting goods segment, but is in sixth position in the e-commerce ranking conducted by the Brazilian Retail and Consumption Society (SBVC), behind B2W Digital, Cnova, Magazine Luiza, Máquina de Vendas and Privalia. “We held the offering within the expected time window and capitalized the company with sufficient resources to carry out medium and long-term plans” says the IR officer.

Top reasons

Reinforce the reliability attributes of a traditional company and, at the same time, afford the expansion plan: those were the main reasons that led Hermes Pardini to become public in 2017. The diagnosis company, founded in 1959 in Belo Horizonte, consolidated with the IPO the professionalization of its management process, which began in 2008, when the Pardini family, founder of the company, left the management and went to compose the Board of Directors. In 2011, the company from Minas Gerais took another step in that direction, with the sale of 30% of its capital to the private equity fund Gávea Investimentos. With the investment cycle completed, the company chose to go public with the sale of interests by the fund and issuance of new shares, to give continuity to the business expansion plan, which includes the entry into new markets and acquisitions.

In 2016, Hermes Pardini bought the Nuclear Medicine Centre of Guanabara, in Rio de Janeiro, with seven units, and expanded its presence in São Paulo. The IPO yielded R$ 877 million, with R$690 million in the secondary offering and R$ 187 million in the initial offering, and the resources are already being used to finance the expansion plan, through the opening of units and acquisition of companies . With a revenue of R$ 971 million in 2016, the company from Minas Gerais is one of the largest in Brazil in laboratory support services, called lab-to-lab in the industry jargon.

According to Fernando Ramos, Hermes Pardini’s Investors Relations officer, “becoming public is a decision that needs to be very well thought out, especially in unstable economy times, but, when you have long-term projects, seek resources in an IPO makes sense” says Ramos. The total cost of the two offerings was R$ 36 million, equivalent to 4.8% of the funds raised. Although the provision of health services is not as sensitive to cyclical economy movements (except for the fact that part of the revenue comes from corporate health plans), in the long run, with the aging of the Brazilian population, the demand for these services should significantly grow, says the IR officer.

Stock exchange fear

Deloitte/IBRI research showed that, for privately held companies, the ignorance about the costs and bureaucracy for the IPO process is one of the reasons that scare them to put this plan into practice. According to the study, 82% of the private companies are unaware of – or partially know – the necessary procedures for holding an IPO. One-third of the organizations (32%) declared the intention to become public, but only 6% say that they intend to do so in the next two years. The reticence occurs even in large companies, since 31% of the sample private companies have annual revenues exceeding R$ 500 million.

However, more than the cost or bureaucracy, for 79% of the private companies that participated in the study, the factor that most ward the organizations off the capital market is the current economic situation. In the evaluation of Edmar Prado Lopes Neto, chairman of IBRI’s Board of Directors, this fear comes from the perception that the stock exchange reflects what occurs in the Brazilian economy in many aspects – among them, the concentration trend in some sectors, such as energy and financial, and the high interest rates, threatening many companies’ liquidity.

“But, in general, Brazilian companies have been well and shown liquidity, even with all the recent events, like the economic crisis, the loss of investments and political instability” says Lopes. We need, he says, to stimulate both the entry of new companies on the stock exchange and direct individuals’ savings to equities.

To Fernando Augusto, from Deloitte, the survey indicates that companies strategically consider becoming public in their business plans, but the preparation only actually occurs when the decision is near. “We are working for this cultural process to begin long before” he says. It is necessary to align the stakeholders’ and investors’ expectations with the company’s financial organization ability and to structure internal control, accounting, auditing, corporate governance, risk management and communication with the market practices within the necessary criteria.

Brazil is still attractive

Even with the delay in the economic growth resumption, Brazil has remained attractive for foreign investment, thanks to international investors’ confidence in the country’s foundations – such as a large consumer market, abundant natural resources, favorable exchange rate and foreign investor’ distance to the local problems.

According to the World Investment Report 2017, a report from the United Nations Conference on Trade and Development (Unctad), which deals with direct international investment flows, Brazil remained attractive in 2016, with a total amount of Foreign Direct Investment of $ 59 billion in the period. The amount made the Country jump from the eighth to the seventh position in the worldwide ranking, although the amount was smaller than in 2015, when the total reached $64 billion.

“The volume of investments that have entered Brazil remains one of the ten largest in the world, and this concerns both direct contributions and companies listed on the stock exchange and private equity funds’ activities” says Diego Barreto, a member of IBRI’s Board of Directors. According to him, this willingness of the foreign investor to contribute resources in Brazil, added to the volume of domestic capital in private equities, are good indicators of a trend of strengthening of the capital market in the medium term. “The intense activity of investment funds, law firms and consultancies is a statement that many companies are already preparing to become public. They are only waiting for a moment of greater stability” concluded Barreto.