Payments without barriers

The consolidation of the behavior of a consumer who is increasingly connected to the digital environment drives, in means of payment, innovations which bring convenience and impose challenges to financial businesses; the 2017 edition of the FEBRABAN Banking Technology Survey, conducted by Deloitte, confirmed the trend

July-September | 2017Before entering the store, you trigger the turnstile by approaching your phone. You enter the location, freely choose the products and put them in the bag, leaving without going through any cashier or attendant. No queues and without interruptions. While going through the exit door, the payment receipt arrives through a smartphone application or by email, because the app connected to the phone sensor automatically recorded everything you got.

This is how Amazon Go, the physical store of the American giant that became known by its global presence in e-commerce, works. Today, the company has become a benchmark in e-commerce innovation and brings its challenge to physical stores. What Amazon did and does? It thinks in a disruptive way and innovates on the appropriateness of the physical and digital means of payment, integrating them and without creating barriers.

When speaking on the current technological revolution, the word that better defines the amount of data, interactions and transactions is “exponential”. However, it’s not about just building something awesome and high-tech that defines if the technology fell into the taste of the audience or whether it will even be useful in everyday life. What determines the success of a digital enterprise is the ability to troubleshoot and provide comfort to users.

The new banking and financial means of payment illustrate well the entire advance and facilities conquered. New means of payment appear in profusion, whether designed by banks, startups or fintech developers. The rule is to not get plastered in old models. Partnerships and open innovation lead consumers to new heights of relationship and convenience, which are more agile and even imperceptible.

[carrosel_custom language=”en”]

The new generation of means of payment

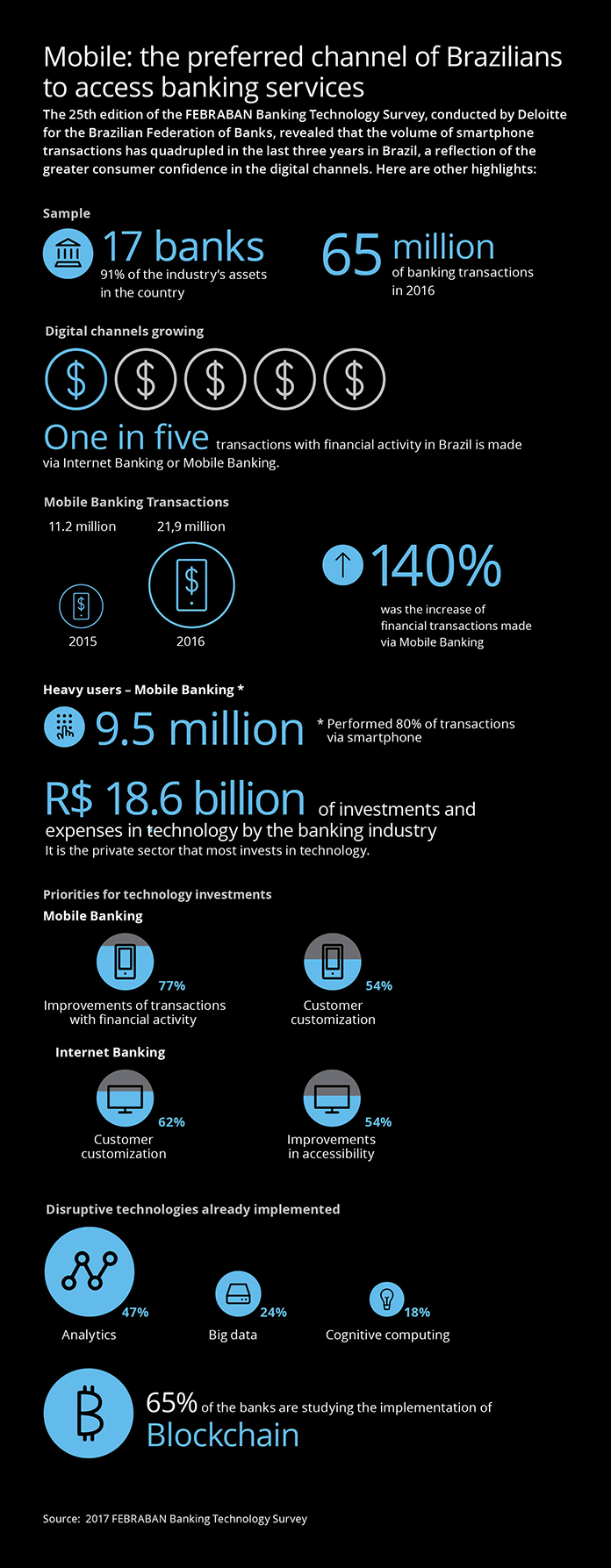

Data from the FEBRABAN 2017 Banking Technology Survey, conducted by Deloitte for the Brazilian Federation of Banks, shows the digital media’s growing importance for the banking industry and consumers’ preference especially for mobile banking. One of the highlights of the survey – carried out with 17 banks, which correspond to 91% of the country’s total banking assets – was the growth in financial transactions in mobile banking. Financial transactions increased from 500 million in 2015, to 1.2 billion in 2016, an increase of 140%. In this scenario, the number of TEDs and DOCs grew 741% from 2015 to 2016 (see more details on the FEBRABAN Banking Technology survey in the box).

For Paschoal Pipolo Baptista, partner of Deloitte’s Business Advisory practice and a specialist in technology for the financial services industry, regardless of the technology implemented, and its purpose, what is essential is that every means of payment developed has four features: convenience (easy to use), simplicity, security and mobility. “The means of payment improve the consumer’s banking experiences by a lot and the digital medium’s growth reflects that.”

The challenge to the banking industry is to determine what role to assume in a moment marked by innovation, new tools and new business models. Gustavo Fosse, FEBRABAN’s Technology and Banking Automation sector director, says the banking services focus on both the security and the best consumer experience. “We focus on usability and convenience, and this increase in mobile banking is the positive response about how means of payment are developing and meeting those expectations. At the other end, we have the traditional consumer, who can use all physical means of customer service. A form of customer service does not eliminate the other” Fosse points out.

From the alliance between banks, financial entities and fintechs in the pursue for solutions, a new type of bank arises, which will be shaped in multiple models, either for the digital or physical means.

Digital payments have an integration role in the sales cycle and the perfect technology is the one present but imperceptible. “The ‘Uber’ factor is already in our daily life. The means of payment are so integrated that you don’t even know which card will the payment be debited from when you ask for a car through the application. Similarly, this already happens in retail, for example, with Amazon Go. The barriers are virtually invisible” explains Paschoal.

Highlights of 2017 FEBRABAN Banking Technology Survey

The Deloitte’s partner believes that what allows such innovation is the integration of various technologies such as Internet of Things (IoT), big data, analytics, artificial intelligence and blockchain. “These technologies coexist in total integration with biometric security tools and passwords. These innovations work in the solution for unresolved points. Each one, either a bank or fintech, has a path to take advantage from them. Knowledge is shared and partnerships exemplify the resolution of these issues.”

In this new ecosystem, the banks remain relevant to enjoy the best of both worlds, the physical and the digital, providing increasingly better experiences. Partnerships with fintechs help in the solutions and new business models. The banks are working to understand the next steps and alliances with fintechs keep them at the forefront., Paschoal Pipolo Baptista, partner of Deloitte's Business Advisory practice and a specialist in technology for the financial services industry.

Biometrics and the end of passwords

Valério Murta, MasterCard Brazil and Cone Sul’s vice president of Products and Solutions, points out that the company does its planning taking into account the generational issues, but without diverting from innovation in all processes. “We have security systems that perform many checks before closing a payment process. The most traditional consumer doesn’t even realize the processes because biometrics, either by fingerprint, facial reading or presence sensor, is very convenient and is used in almost all transactions. This technology facilitates and enhances security. The digital natives will not have credit cards, they will go straight to virtual cards and smartphone applications. The solutions include all audiences.”

The company should soon bring to Brazil a technology that is in test in South Africa: a card with a chip, PIN and fingerprint. “We believe that biometrics will replace passwords. Our big bet on security led to the acquisition of NuData Security, a startup that designs solutions against online and mobile fraud. The technologies developed are based on biometric indicators on the use of smartphones, of time and usage method. Our priority is to launch products with this technology in Brazil and incorporate it in all mobile means of payment”, explains Murta.

For the MasterCard executive, the Internet of Things is hyper-connecting the world. “It is not difficult to realize that each device, from the biker’s bracelet to pay the toll to the smartphone, is becoming an efficient and secure means of payment, developed based on how the consumer acts and performs transactions.” Another important solution remembered by the executive is the QR Code, or quick response code. “It is a trend. And the trends are given by the processes and barriers they eliminate. A website vendor does not need to generate an invoice for payment, he just needs a QR Code. Any instrument can be a means of payment because the digital convergence has come to what we always dreamed of, it came to the full integration. This gives new utility to smartphones, browsers, tablets, and solutions to the user in general” says Murta.

For Visa, the end of the credit card is already happening. “Plastic will give rise to new means of payment. We can’t say for sure, but I believe that in the future, what we will have the most are payment options by approximation, with several objects being redefined, not only the mobile. The gaps are not yet filled and we will have to choose between five or ten options. It is not yet clear if the payment will happen more through watches, bracelets and mobile phones, or by the digital bank” says Percival Jatobá, Visa Products’ vice president.

Solutions for people and businesses

For the director of Deloitte’s Business Advisory practice and specialist in the Financial Services industry, Marcelo Wakatsuki, when it comes to the individual consumer, the new digital payment solutions are more focused on the use of mobile, which is the instrument with greater market penetration. An example of this trend pointed out by Wakatsuki is WeChat, a tool used in China similar to WhatsApp, but that allows transactions with values between users. “Facebook has already understood WeChat as a threat and is working to offer that kind of payment experience in its portfolio”.

There is a considerable potential for new payment solutions for companies, which use cutting-edge technologies and improve user experience with agility and security., Marcello Wakatsuki, director of Deloitte's Business Advisory practice for the Financial Services industry.

Wakatsuki points the credit card companies as one of the innovation vectors. In common with banks, there are open innovation developments and partnerships with fintechs. Technological advances are important and change the way of doing business of companies, which start testing and enhancing pilot projects to offer solutions and remain essential in the consumer’s life.

“The use of blockchain can be disruptive in the long term. Most of the ongoing initiatives are in pilot to test phases. We don’t know yet how blockchain will evolve, however, conceptually, these solutions can cause the disintermediation of part of the payments’ value chain. In addition to the removal of links in the chain, blockchain also provides security with a shared records structure. In practice, we understand that blockchain will need a minimum governance and regulation structure to gain space”, says the Deloitte’s Director.

Why does it make sense for a credit card company to encourage new B2B payment solutions? “A pretty big portion of B2B payments are made through bank invoices. The credit card company does not participate in this value chain. This portion can be captured by new electronic payment solutions, increasing the relevance of the credit card companies in this segment.” says Wakatsuki.

In Brazil, Visa launched in partnership with Bradesco the first Facebook Messenger chatbot of the Brazilian retail sector. The tool offers the possibility of shopping without leaving the Messenger, within the ShopFácil, Bradesco’s e-commerce portal, environment. The novelty allows the purchase, the choice of the payment method and shipping address to be defined within Messenger. “The possibility of payment through Facebook closes the cycle and offers a complete shopping experience on a same platform” explains Percival Jatobá, from Visa.

Visa has an open innovation platform for development of APIs (Application Programming Interface; a programming standard that integrates different systems and platforms to provide a single interface to the user), called Visa Developer. “We sliced part of our operating system and opened to developers about 200 APIs, focused on 13 solutions. The opening is important, because it puts us in a constant innovation environment, but business models are still being developed” says Jatoba.

In this ecosystem, where new means of payment appear daily, with huge features, partnerships are part of the strategy. They accelerate projects and work, in the present, in the same way they draw the future: building relationships with consumers and sharing innovations.