Mobile identity

The mobile and connected digital world has transformed the telecommunications industry, its processes and the design of its future. After the impacts of the economic crisis, the search for a new identity for the segment continues in 2017.

October-December | 2016

The so decanted digital transformation has impacted irreversibly many sectors of the world economy. The change, they say, is so great as were the first stages of the Industrial Revolution. In the technological environment, the transformation happened quickly and intensely, broke paradigms and has created an avalanche of questions, which, if answered, will confirm or dictate the industry and society’s trends. In the face of the revision of models and values, the telecommunications market is seeking for an identity aligned to a changing world – a process that tends to intensify already in the short term. All this in the midst, still, of the impacts of the turbulent economic situation that recently struck the country.

In addition to these disruptive challenges, the telecommunications concessionaires still carry on their shoulders the responsibilities, obligations and penalties that affect the investment capacity, a result generated in large part, according to them, by the General Law of Telecommunications (LGT), of 1997, which needs to be revised to be aligned to the real needs of the industry’s agents.

According to estimates from André Borges, secretary from the Ministry of Science, Technology, Innovation and Communications (MCTIC), the Bill Draft (PL) for the revision of the LGT should be brought for discussion still in 2016 or until mid-2017. Luiz Alexandre Garcia, Algar’s CEO and also one of the advisers to the National Union of Telephony and Mobile and Personal Cell Phone Service Companies (SindiTelebrasil), points out that “The LGT has 20 years and its review will contribute a lot to the telecommunications development and investor confidence. We need a law that brings regulatory stability, considering that investments in the sector are long term.”

Juarez Quadros, President of the National Telecommunications Agency (Anatel), highlights among the concerns the need for the department to be autonomous and guided by its Council. “Anatel has not had the necessary strength to regulate the sector”, he said in his inauguration speech in October 2016. In the same month, in the Futurecom telecommunications event, in São Paulo, he warned that the sector’s ecosystem grew more than the Agency and that it cannot let itself be trampled by the innovation. “Anate’s obligations are sealed in articles 18 and 19 of the General Law of Telecommunications and they ceased to be respected in the last 14 years. We need to make them comply.”

Economic impacts

In this scenario under review, the difficulties are aggravated by the economic turmoil. Eduardo Levy, SindiTelebrasil’s president, says that the industry is going through the worst year since privatization.

According to Levy, the reason is the combination of factors led by the economic crisis, which brought several consequences, such as the taxation hike on telecommunication services to expand the collection in the public sector, the dramatic increase of interest rates on consumer credit and the decline of investments. “All of this has generated a consistent retraction, one of the largest losses of consumer purchasing power since 1930, which has shaken the revenues of the telephony and telecommunications services’ market actors”, says the SindiTelebrasil’s president.

Stefano De Angelis, TIM’s CEO, recognizes that 2016 was a difficult year for the carrier. “We indeed had problems with our network’s quality and we want to recover our position and progress to be a carrier of quality, able to successfully compete in the high value market. Our goal is to be a leader as a mobile provider of ultra-broadband”, he said.

From consumer in mutation to OTTs

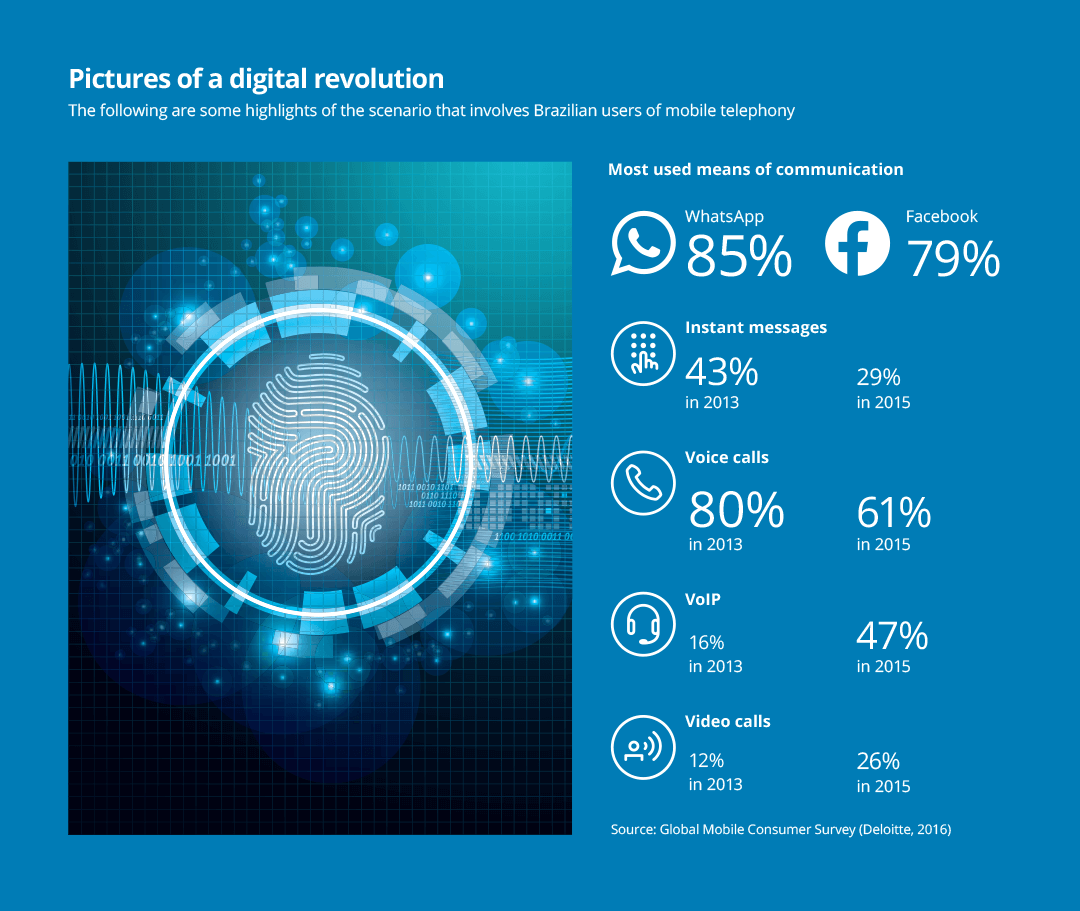

The local recessionary environment is a background in a disruptive panorama, with all the changes driven by the adherence to technological resources that carved a new consumer profile. The 2016 issue of the “Global Mobile Consumer Survey” study, conducted by Deloitte with 53 thousand consumers in 31 countries, including Brazil, confirms the change of habit of the user of telecommunications services, media and technology, nowadays much more toward the communication via instant messaging, against the ones performed by voice (see more details about the study in the box below).

Today, the market understands that the consumer is the great protagonist of the digital ecosystem, deciding and choosing the best products and services, anticipating their expectations. These have gained strength through social networks.

For Solange Carvalho, Deloitte’s director for the Telecommunications, Media and Technology industry practice, the reduction in the use of the mobile device to perform traditional voice calls is a phenomenon that is being closely monitored, and that causes concern among the telephony carriers. “The telcos have been dedicated to rethink their business models to meet the trends and remain capitalized”, she says.

“The telcos have been dedicated to rethink their business models to meet the trends and remain capitalized.” Solange Carvalho

Another obstacle to the Telcos are the so-called Over the Top (OTT), which are services that the user receives via the Internet. They do not have their own infrastructure and “ride” on the network built and maintained by the carriers. This has been a controversial issue since the carriers, according to them, are losing, for a long time, revenue with these services. Examples that fall into this category are WhatsApp, Netflix, Telegram and YouTube.

In the carriers’ evaluation, the controversy revolves around the fact that the OTTs enjoy a “privileged” position, considering that they are not subject to the same regulations, upsetting the market. On the other hand, the OTTs say the telcos earn in the traffic increase in the networks and consequent rise of demand for more robust packages with more bandwidth.

The stalemate begins on the OTTs’ classification. After all, do they fall under Value Added (SVA) or telecommunications service? Twitter is a communication service similar to SMS and, therefore, would it have to be regulated as such? E-commerce with VoIP interaction between supplier and customer can be defined as a phone call? These are just a few examples of a structural identity crisis to be resolved.

Eduardo Levy, from SindiTelebrasil, argues that these asymmetries must be corrected. According to him, the OTTs do not fall under the SVA modality, in accordance with Article 61 of the LGT. “This article says that value added service is the activity that adds, to a telecommunications service that supports it and which should not be confused with it, new utilities related to access, storage, presentation, handling or retrieval of information”, he argues. Anatel and the government have been questioned on the subject, but there is no definition, rather there are discussions in progress.

The OTTs’ impact is confirmed in this year’s Deloitte’s study of the habits of mobile phone users. The use of voice calls has dropped almost 20 percentage points between 2013 and 2015. The 2016 survey showed that 47% of respondents use their smartphones to conduct voice calls through the IP protocol, which are offered by OTTs – three years ago, it was barely around 16%. WhatsApp’s penetration is impressive.

Future under construction

The market’s movement also includes new players, such as the insurance company Porto Seguro, through Porto Seguro Conecta, first virtual mobile carrier to operate in Brazil. Created in 2013, the carrier offers cellular and mobile broadband packages to the end consumer.

Unlike OTTs, the operation receives virtual operator’ regulation, from Anatel. These are the so-called Mobile Virtual Network Operator (MVNO). They do not have their own infrastructure or frequencies. In the case of Porto Seguro Conecta, the network is leased from TIM. The big advantage of the business is the use of the customer base of the insurance company, which has approximately 8.5 million active customers. The goal is aggressive: a total of 1 million accounts by 2018. Today, with over 430 thousand accesses, with the majority being users of the M2M (machine to machine) technology.

“We’re not going to compete with traditional carriers. Our banner is to offer a differentiated treatment to customers and gain those who would like a VIP treatment”, says James Galli, Porto Seguro Conecta’s general manager. Among the services is the hand delivery of the mobile phone in the client’s hands who forgot it somewhere, the loan by the carrier of a device for up to 30 days, if the customer’s has been stolen or has a damaged device, and an insurance for the cases of theft.

Increased connectivity

The market signals a future with heavy investment in broadband, mobility and 5G on the way. For this, however, the networks need to become digital and virtual, with features that support, for example, in accordance with 2020 estimates, the 20 billion devices that will be connected to them due to the Internet of Things’ (IoT) impulse.

According to data from the Brazilian Association of Telecommunications (Telebrasil), in Brazil, mobile broadband has recorded 197.3 million accesses (3G and 4G) in August 2016, while fixed broadband totaled 26.3 million. The two modalities totaled 223.6 million accesses during that month.

“However, we are still an analog country. We have advanced very little” regrets Levy, from SindiTelebrasil. For him, Brazil has a lot to grow in the digital model, in particular, in the provision of services to the citizen. “The government needs to be, in a near future, the largest customer of carriers. After all, since the privatization, the Telcos have already invested R$ 500 billion. We need to offer to society and to companies all the transparency and facilities that only the digital technology can provide”, he suggests.

IoT is another big bet and also depends on the sector’s direction. One of the recent initiatives in this area was the creation of the Brazilian Association of Internet of Things (ABINC), dedicated to building a collaborative IoT network. “It is a physical network for data transmission, in which each member invests in their equipment. We want to unite to bring down the connectivity barriers”, said Flavio Maeda, ABINC’s president, who reveals to be creating a working group focused on the regulations with companies like Microsoft, Cisco and CPqD.

One of the protagonists of this progress is José Gontijo, MCTIC’s Director of the Department of Industry, Science and Technology. Gontijo tells that, in 2013, with the challenge to increase productivity in the Country, the Ministry realized that this could only be done through technology and made the decision to create, in 2014, the Internet of Things Board.

Now is the time to accelerate the IoT’s National Plan. “In the Plan, we will deal with the matter through public consultation, addressing taxation and technology, and all of this not only via telecommunications carriers, but also through the private initiative”, said Gontijo, adding that one of the biggest challenges is the IoT’s systems interoperability, followed by professional training. “My IoT’s vision is like a mobile phone app. Simple, immediate. A technology that is more flexible and capable of generating great business models”.

Among the actions revealed by the executive is the establishment of the IoT’s National Plan in government branches (Federal, State and Local) and the adoption of IoT solutions, which will impact the efficiency of the management and provision of public services, in addition to the efforts to establish the electronics and robotics knowledge in the basic education.

In this big forum of discussions and contributions, everything moves toward a renewed, more aligned and digital industry. Over the next five or six years, probably “everything” and everyone will be connected. And this progress needs to go through more discussions, collaborations, and technological standards and, in particular, through the revision of the LGT in Brazil. This is the only way that the industry will be able to plan and direct with assertiveness the investments to remain competitive and become more attractive to global investments.

To access the contents of “2016 Global Mobile Consumer Survey” in its entirety, click here