Gradual resumption

The forecasts of analysts, entrepreneurs, government and market agents for 2017 indicate optimism for a consistent resumption - albeit not accelerated - of the economic growth and local and foreign investments.

October-December | 2016“We now have the worst recession since 1930. The results for companies and consumers are very serious. The credit is suffering; the banks are suffering. But the Country will overcome the crisis already at the beginning of 2017”. Words of the Minister of Finance, Henrique Meirelles, spoken to the press of the United States in a recent visit to New York. With the cooling of the recent political turmoil, the consolidation of a new team in charge of the economy and the gradual resumption of the confidence from the market, the statements of the minister corroborate other optimistic predictions about the near future. The vision of the entrepreneurs captured by the “Agenda 2017” survey about the prospects for revenue and investment growth (see the box at the end of this piece) endorses this optimism.

In the course of 2016, the projections on the main macroeconomic indicators were slowly improving and point, after all, to a resumption of growth of the Gross Domestic Product (GDP) and the beginning of a recovery of the levels of economic activity in 2017. The advances in the discussions on the Proposal for Constitutional Amendment (PEC) 241 – which sets a ceiling for public spending, with the goal to contain the chronic fiscal imbalance – have also been seen as positive signs.

“The resumption of trust is the crucial element for the economy recovery”, the President of the Central Bank (BC), Ilan Goldfajn, said in September. “It is essential to persevere in the adjustments and reforms of the Brazilian economy to reduce uncertainties and offer prospects for sustainable growth, in addition to a low and stable inflation in the future”, he defended.

The International Monetary Fund (IMF) traces the same route for the Country: “With the return to normality in the home environment and some structural reforms, the conditions for the return of normal growth rates are created, already at some point in 2017”, said Oya Celasun, Chief of the Division of Global Studies of the IMF.

Walking sideways

“The recovery tends to be small, nothing overwhelming, but probably will happen”, says Eduardo Martins, Deloitte Financial Advisory lead partner in Brazil, regarding the route for 2017.

Fabio Astrauskas, Insper’s coordinator and member of the Brazilian Institute of Corporate Governance (IBGC), sees a similar picture for 2017. “The growth will be small, almost zero, but, without doubt, there will be a progress compared to the last two years. If the government’s agenda gets momentum, I see the possibility of a little larger progress, helped by the fall of the inflation. We will overcome the recession, but we will still heavily depend on structural reforms. The government cannot give conflicting signs; it must act with assertiveness”, says Astrauskas.

For Zeina Latif, chief economist of XP Investments, 2017 will be a year “to have some patience in overcoming the problems”. She lists some of them: “high delinquency, difficulties in collecting taxes, companies’ leverage level still growing, fall in revenue, very high interest rates. It is not possible to overcome this from night to day.”

The economist shares the moderately optimistic vision traced for the year. “We are in a healing process. We do have a positive picture, but it is not yet possible to expect a fast cyclical return of the growth. In some quarters, we will see the economy ‘walking sideways’, while the various segments complete their cycles of adjustments.”

Investments and financing

“With a more stable political scenario and the expected implementation of structural reforms, Brazil will be an attractive destination for investment. A lot of money from abroad will come”, says José Cláudio Securato, president of the Brazilian Institute of Finance Executives (IBEF). “The gaining of internal confidence will also be extended to international investors. There is an excess of liquidity in the world, that emerging markets cannot completely absorb. The world has an eye on our assets.”

Zeina Latif tends to agree. “With the relaxation of monetary conditions, the appetite of internal and external investors will increase. It will not be abrupt, as it was in the past decade, but it is a real trend. Internally, the resumption of investments will depend on an improvement in the fall of delinquency and the decline in layoffs. These are signs that the market expects, especially in sectors linked to domestic consumption.”

For Eduardo Martins, from Deloitte, the time is ripe for the entry of strategic investors. “The Brazilian assets are with a more realistic price, unlike what happened about three years ago. For investors who think medium and long term, we are a very attractive market. There are good opportunities for investments in the sectors of health, education, technology and infrastructure.”

In a context in which there are companies in a delicate financial situation, the National Bank of Economic and Social Development (BNDES) also hopes that the Productive Assets Revitalization Program, released in August, will help to heat the market. With a budget of R$ 5 billion, the initiative supports the purchase of assets that are economically viable from companies in a situation of judicial or extrajudicial recovery, bankruptcy or high credit risk. “When a company under recovery process offers its assets to third parties, the BNDES operates in the financing of this transfer”, explains Gustavo Lellis Peçanha, Head of the Legal Department of the Credit area from the bank. “The company in recovery is capitalized in the process, and the assets collaborate with the maintenance of the economic activity and preservation of jobs.”

Infrastructure

In September, the Federal Government has announced the schedule of infrastructure auctions of the Investment Partnership Program (PPI), which begin in the first half of 2017 and will cover airports, ports, highways, railways, terminals, sanitation and energy distribution. The concessions and private investment in the sector are seen as important development engines and should help to boost the economy, to the extent that they cover the gaps that the public power cannot remedy. “I see opportunities mainly to suppliers of capital goods, machinery and equipment”, says Fabio Astrauskas, from IBGC.

Zeina Latif, from XP Investments, adds that the new auctions point to a promising future for the infrastructure segment. “The agenda will mature more starting the next presidential term. However, it is a symbolic start, which represents a positive change from the public sector to the private”. The chief economist from XP considers: “There are still large challenges, such as the lack of consistent projects and insecurity in the legal, regulatory and environmental fields. The interest rates will also need to go down, which would increase the attractiveness of the concessions.”

In order to establish clearer rules and give agility to the processes, the PPI will define a hierarchy in the analysis of infrastructure projects. These enterprises will have priority in the granting of environmental and urban planning licenses and other relevant regulations to be monitored by the technical bodies. “To absorb foreign investments, the rules need to be reviewed and there should be more clarity and stability. The regulatory agencies need autonomy. And the licensing procedures need to be faster – we respect the regulations, but the deadlines need to improve”, says Securato, from IBEF.

“Throughout the world, the interest rates are low and investors are looking for opportunities. With guarantees of profitability, political stability and legal safety, the money will come.”

Eduardo Martins

For Eduardo Martins, from Deloitte, the Brazilian shortcomings in infrastructure, combined with the international economic situation, make the segment very attractive to external eyes. “If the government really put its plans into practice, this round of auctions will bring positive impacts before the end of 2017. Throughout the world, the interest rates are low and investors are looking for opportunities. With guarantees of profitability, political stability and legal safety, the money will come.”

IPOs and capital markets

After a long “drought” of initial public offerings of shares (IPOs) on the BM&F Bovespa, the consensus among observers is that in 2017 this scenario will change. The latest IPO on the São Paulo Stock Exchange was of the Alliar Médicos à Frente, in October 2016, after more than a year without operations in that direction. The uncertainty about the panorama and the recession inhibited new offerings; Brazil, which was once the second largest market in the world for IPOs (behind only China), it was not even among the top 15 in 2015. The Bloomberg news agency found that the total offerings of shares in Brazil in 2016 dropped around 72% over the previous year.

The resumption of the confidence and the consolidation of the reforms will rekindle the capital market. “There are around 50 companies with their offers retained, which must arise in 2017”, said Edemir Pinto, president of BM&F Bovespa, who said he believes that most of the future investors will come from abroad. “The government needs to make cash and there is a high expectation in relation to concessions and privatizations. This will cause the capital market to be a key growth lever.”

Eduardo Martins warns that the movement, albeit very positive, should not put the Brazilian market back to the first places in the world ranking. Even so, the Deloitte’s partner estimates that only among investment funds there are “between 15 and 20 companies” preparing to offer their shares on the BM&F Bovespa. “However, the actual number of offerings can be much larger than this. The market is stopped for a long time and needs to move.”

The IBEF’s President confirms these views. “The companies are already calculating their pricing and understanding the volumes to be offered, waiting for the best time”, says José Cláudio Securato.

Mergers and acquisitions

Unlike the stock market, there was a movement in the sector of mergers and acquisitions in 2015 and 2016, a scenario also arising from the economic crisis. Large businesses in sectors like education (with the purchase of Estácio by Kroton), distribution of fuels (acquisition of the gas stations network Ale by Ultrapar) and energy (CPFL buying AES Sul) were registered. In the financial market, there was the merger between BM&F Bovespa and Cetip, uniting the segments of fixed and variable income in Brazil, and the purchase of Citibank’s retail operations by Itaú.

For the president of the Mergers and Acquisitions Committee of the Brazilian Association of Financial and Capital Market Entities (Anbima), Ubiratan Machado, “the worst is behind us and we now have a cautious optimism”. According to Machado, sectors such as finance, oil and gas and electricity, which led the ranking of the negotiations in 2016, should continue to be the highlights in 2017.

“Companies that managed to remain capitalized and efficient took the time to get closer to the competition and gain market share, aiming at targets that were indebted”, explains José Cláudio Securato. “We see many teams specialized in mergers and acquisitions forming, in search for good deals, including a lot of preparation for entering into agreements and conducting due diligence engagements”, confirms Fábio Astrauskas, from IBGC.

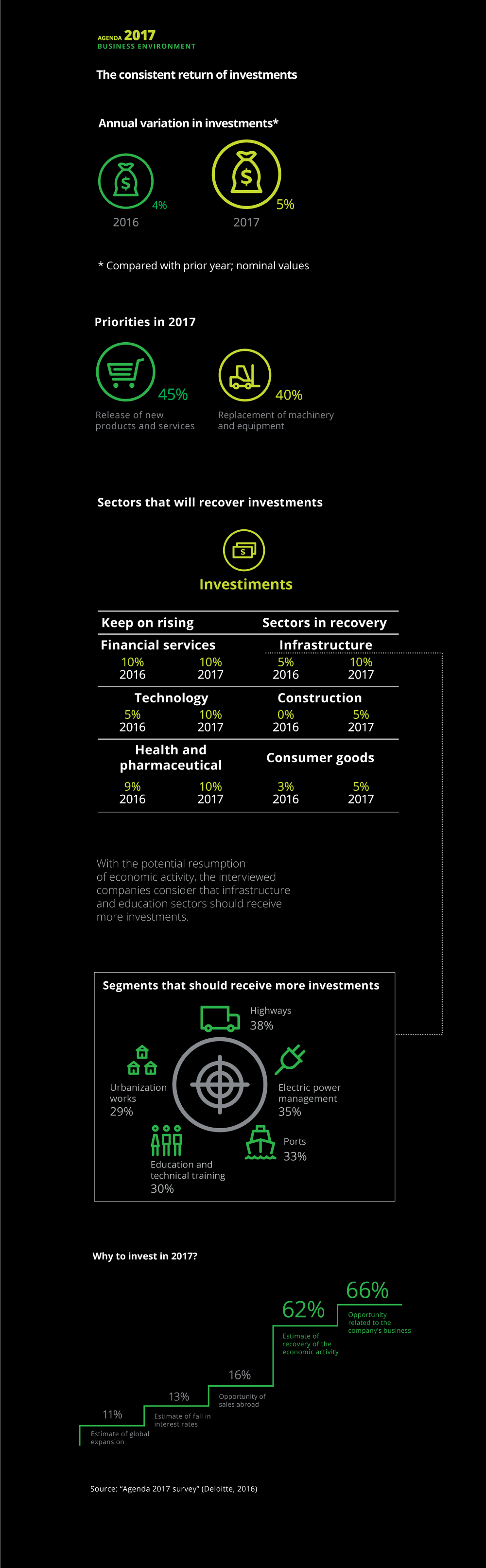

To access the contents of “Agenda 2017” survey in its entirety, click here